Recording Transactions

Logging all business income and expenses. Entering sales, purchases, and other financial transactions into accounting software.

Categorizing Transactions

Classifying transactions into appropriate accounts (e.g., rent, utilities, cost of goods sold). Ensuring compliance with accounting standards.

Bank and Credit Card Reconciliation

Comparing bank and credit card statements with recorded transactions. Identifying and resolving discrepancies to ensure accuracy.Accounts Payable Management Recording vendor bills and expenses. Tracking due dates and processing payments to suppliers.

Accounts Payable Management

Recording vendor bills and expenses. Tracking due dates and processing payments to suppliers.

Accounts Receivable Management

Generating and sending invoices to customers. Recording payments received and following up on outstanding receivables.

Payroll Processing

Recording payroll transactions, including wages, bonuses, and deductions. Ensuring proper accounting for payroll taxes.

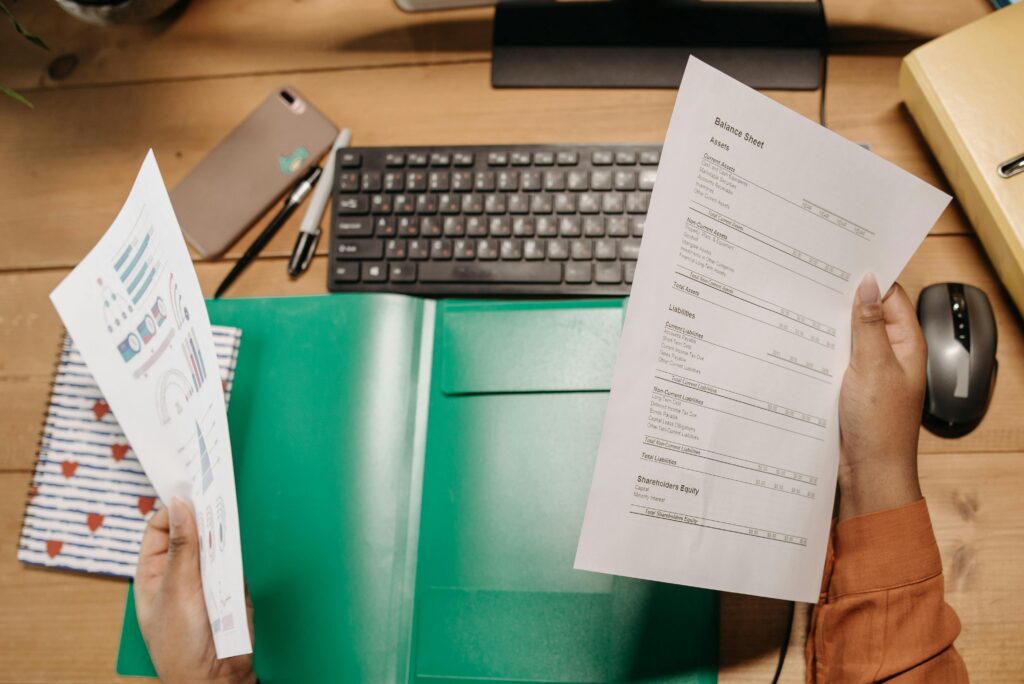

Financial Reporting

Generating financial statements such as: Income Statement (Profit and Loss Statement) Balance SheetCash Flow Statement.Providing customized reports for business insights.

Tax-Ready Books

Organizing records to ensure all transactions are ready for tax filing.

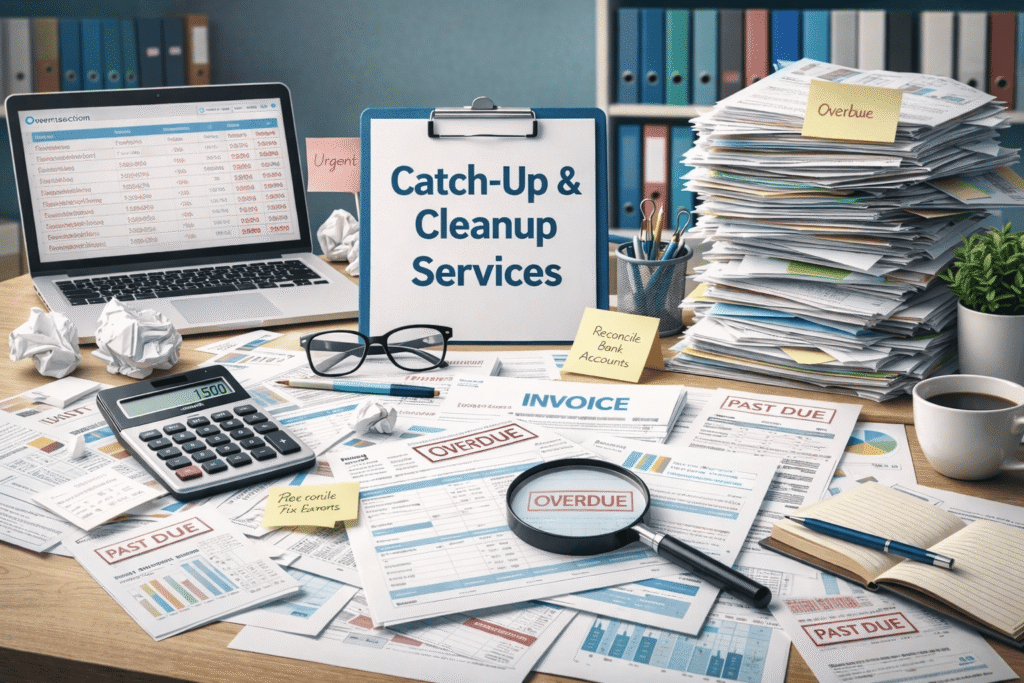

Clean-Up and Catch-Up

Fixing errors in financial records. Updating books that have fallen behind.

Form 1099-NEC filing

E-file all 1099-NEC forms with the IRS and email copies directly to your contractors. You will receive a copy of all filed forms for your records.

Monthly Bookkeeping

Expert handling of your account, ensuring accurate and efficient financial management.

Remote Bookkeeping

We offer remote bookkeeping services providing accurate and timely financial management from anywhere. You will receive a copy of all filed forms for your records.